Child Tax Credit 2024 Amount Chart – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . During the COVID pandemic, the child tax credit was expanded with payments made monthly. It’s back to pre-pandemic levels, however, but, if you have children under the age of 17, you could be eligible .

Child Tax Credit 2024 Amount Chart

Source : itep.org

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

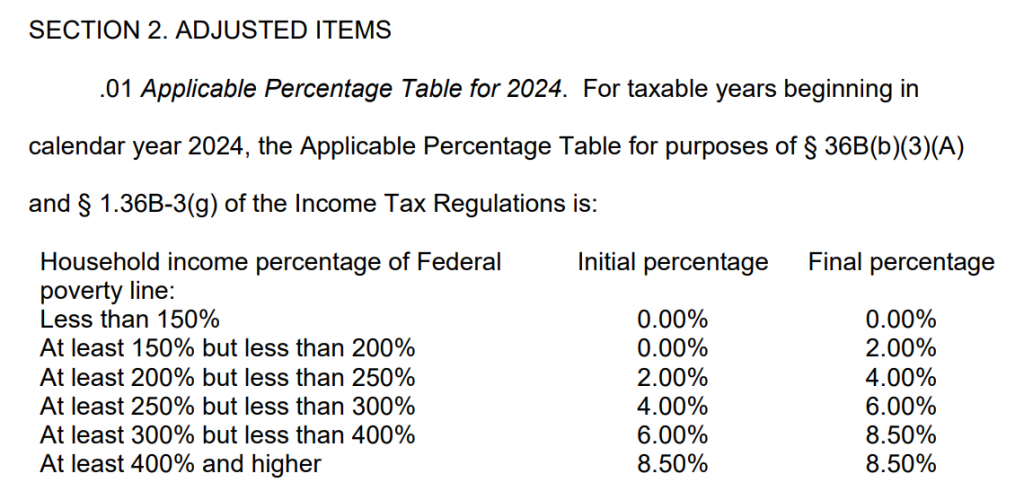

IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA

Source : www.cpapracticeadvisor.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

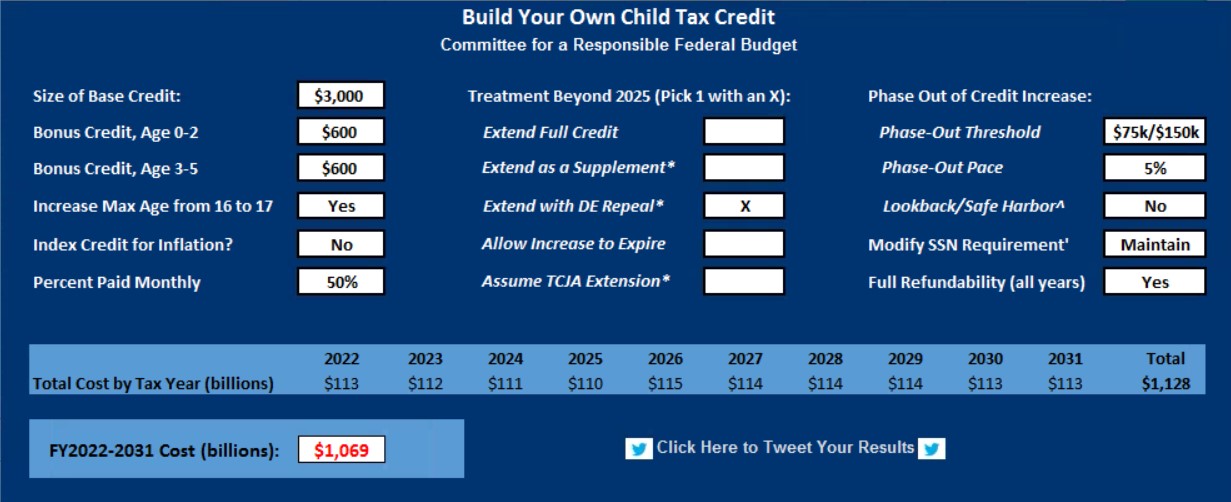

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

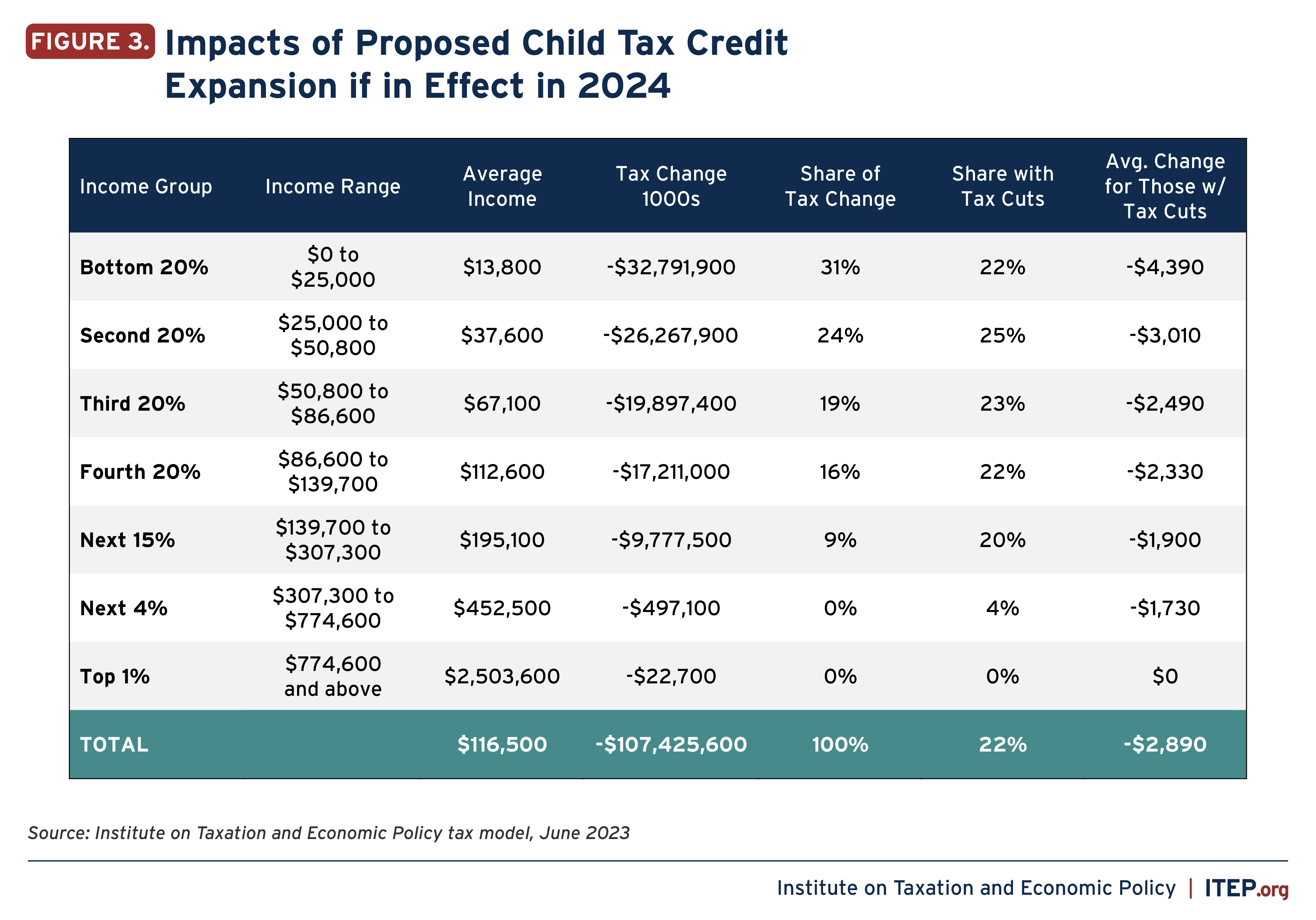

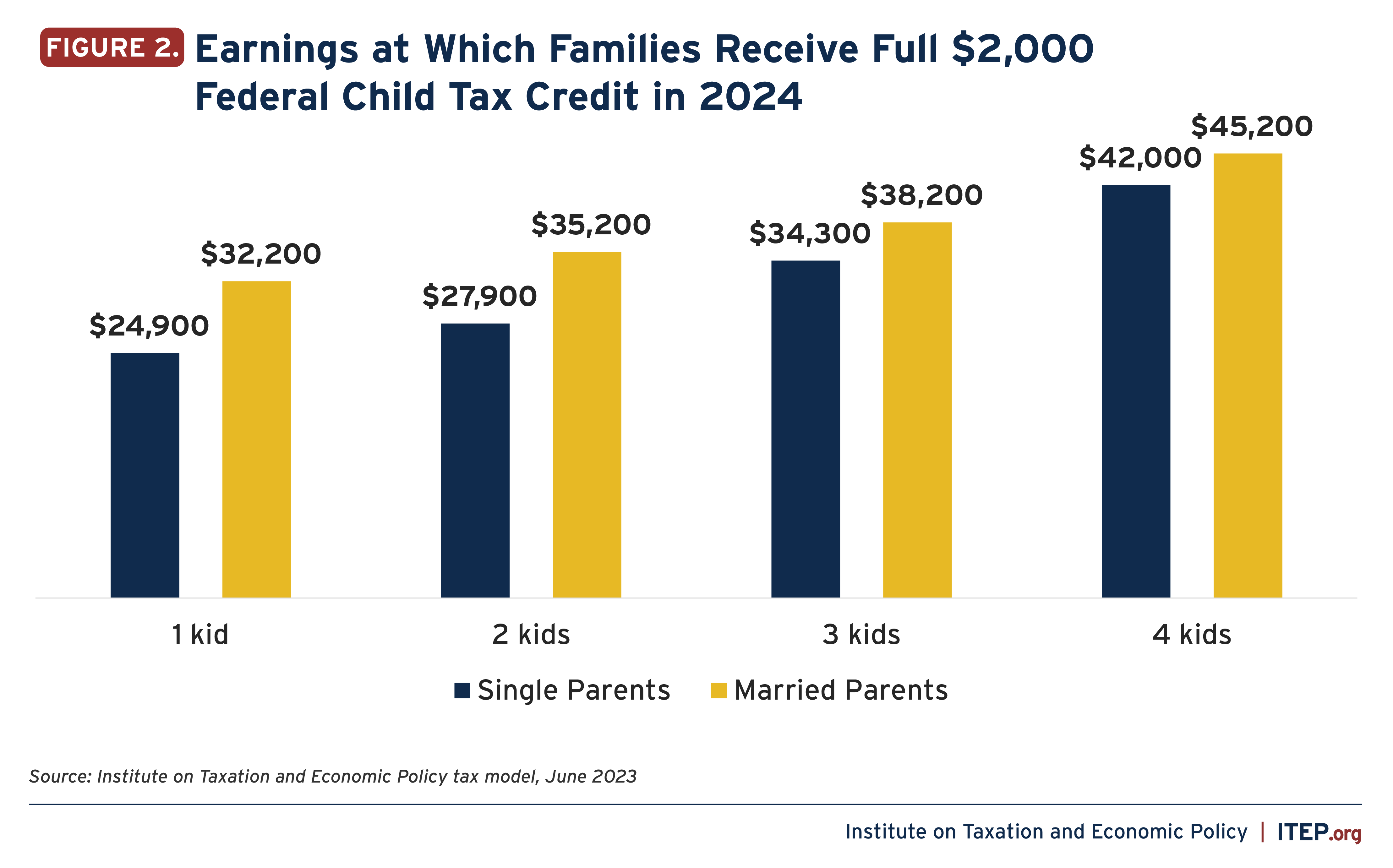

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

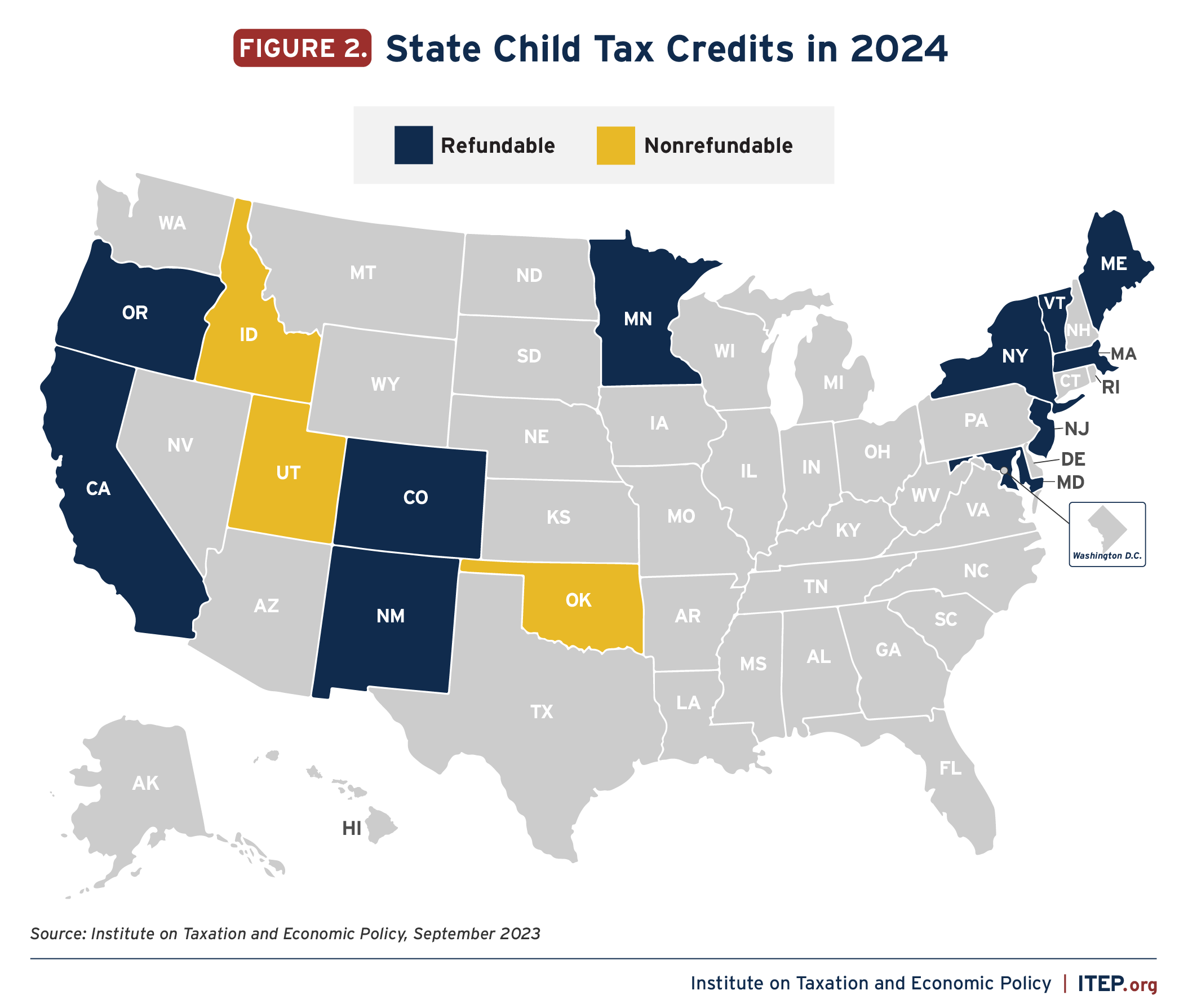

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2024 Amount Chart Expanding the Child Tax Credit Would Help Nearly 60 Million Kids : What to expect for 2024 qualifications and amounts for these credits and deductions can change from year to year. While you might already know about the 2023 child tax credit and other . Personal Finance. Child Tax Credits 2023: What can you do if you haven’t received your refund? Personal Finance. CalFresh IRT Chart: What happens if you don’t report income change to CalFresh? .